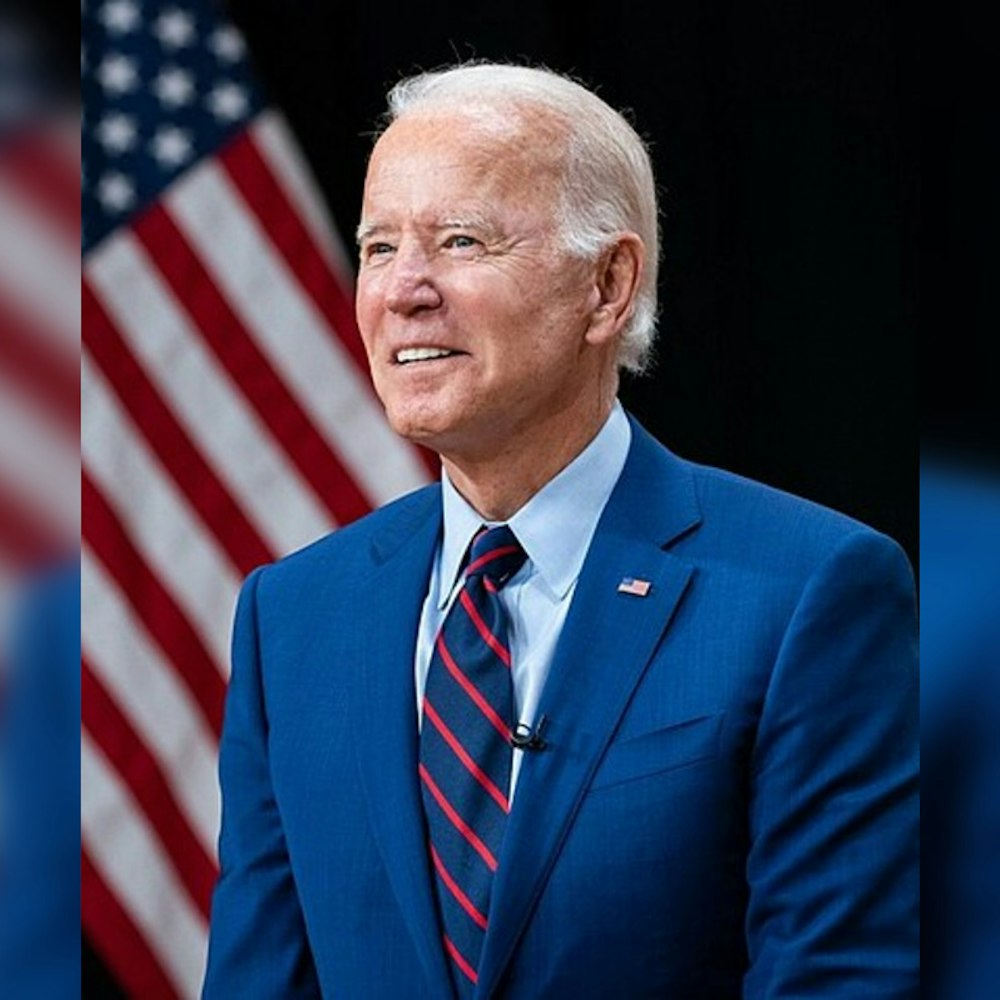

San Diegans have been given extra time by the government to deal with their taxes following severe storms in January. The IRS and California Franchise Tax Board have extended the deadline for tax payments until June 17 for people in San Diego County. This decision was made after Governor Gavin Newsom highlighted the difficulties faced by the area due to the disaster. The President approved this extension on February 19, according to Cal OES.

This extension gives residents and businesses more time to file their tax returns and make payments. It includes various types of tax payments that are typically due in April, as well as payments for taxes due between January 21 and June 17.

For those affected by the storms, there are additional benefits available. The FTB Publication 1034 outlines how to claim a deduction for disaster losses, which can help reduce taxable income for this year or next year. The FTB also offers faster refunds for those who qualify.

If anyone receives a penalty notice for late payment, they can contact the IRS to resolve the issue and avoid fines.

San Diegans struggling financially due to the storms can also get a free copy of their state tax returns by filling out FTB form 3516. The FTB website provides information on options like reasonable cause or extreme financial hardship, which could lead to a reprieve from penalties on a case-by-case basis. Additionally, individuals can inquire about one-time penalty.

-1.webp?w=1000&h=1000&fit=crop&crop:edges)